Bonds

Total return buyers need to buy a bond when its price is low and sell it when the worth has risen, somewhat than holding the bond to maturity. You may also discover greater coupon rates on company bonds than on U.S. treasury bonds with comparable maturities. In the company market, bonds with decrease credit rankings usually pay greater income than greater credits with comparable maturities. Instead of going to a financial institution, the company gets the money from traders who buy its bonds.

Types Of Bond Risk

The increased value will deliver the bond’s complete yield right down to 4% for new investors as a result of they should pay an quantity above par worth to buy the bond. When you invest in a bond, you realize that it’s probably going to be sending you curiosity revenue often. There is a hazard on this, though, in that you simply cannot predict ahead of time the precise rate at which you will be able to reinvest the money. If interest rates have dropped significantly, you’ll need to put your fresh curiosity income to work in bonds yielding decrease returns than you had been having fun with. Imagine The Coca-Cola Company needed to borrow $10 billion from investors to accumulate a big tea company in Asia.

The investor sells the unique bond at a loss, which can be utilized to offset the taxable capital achieve or up to $three,000 in ordinary earnings. He or she then purchases another bond with maturity, price and coupon just like the one bought, thus reestablishing the place. Owners of callable securities are expressing the implicit view that yields will stay relatively stable, enabling the investor to capture https://www.beaxy.com/ the yield spread over noncallable securities of similar period. Using bonds to take a position for complete return, or a mixture of capital appreciation (development) and revenue, requires a more energetic buying and selling technique and a view on the direction of the financial system and interest rates.

In addition, I will provide you with sensible, usable information, to empower you to take charge of your financial life, bringing clarity to the advanced. However, the returns on bonds these days have come virtually totally from the falling yields that have sent their prices greater. That hasn’t all the time been the case, with the interest that the bonds themselves pay sometimes being a way more essential part of bonds’ total returns. Bonds are complicated to many buyers, and one main source of confusion is how bond costs transfer.

Bonds are typically most liquid in the interval instantly after problem. Liquidity threat is normally lower for presidency bonds than for corporate bonds. This is because of the extremely massive issue sizes of most authorities bonds. However the sovereign debt crisis has resulted in a decline within https://1investing.in/ the liquidity of presidency bonds issued by smaller European peripheral nations. Unless you plan to stick with protected and safe Treasurys, you want a big amount of cash to place together a diversified bond portfolio and never give up too much in worth markups.

An unanticipated downgrade will cause the market value of the bond to fall. Most government bonds are denominated in models of $a thousand in the United States, or in models of £a hundred within the United Kingdom. Hence, a deep discount US bond, promoting at a value of 75.26, signifies a promoting worth of $752.60 per bond sold.

The bond market supplies traders with a gentle, albeit nominal, source of normal revenue. In some cases, such as Treasury bonds issued by the federal government, buyers obtain bi-annual curiosity payments. Many investors choose to carry bonds in their portfolios as a way to save for retirement, for their youngsters’s education, or other lengthy-time period wants. However, if interest rates begin to decline and related bonds are now issued with a 4% coupon, the unique bond has turn out to be extra useful. Investors who want a higher coupon price must pay further for the bond in order to entice the original owner to sell.

However, whilst stock markets have fallen, one other asset class has accomplished well. Many bond investments have gained a big quantity of worth thus far in 2020, and that’s helped these with balanced portfolios with each shares and bonds hold up better than they might’ve in any other case.

Bond yields have fallen sharply because the Fed has reduce rates of interest, and it’s natural to assume that falling yields would make bonds much less desirable. However, when bond yields fall, prices on present bonds rise, because those current bonds pay larger interest that appears more attractive when prevailing rates on new bonds go down.

It believes the market will enable it to set the coupon rate at 2.5% for its desired maturity date, which is 10 years sooner or later. It issues every bond at a par value of $1,000 and promises to pay pro-rata curiosity semi-yearly. Through an funding bank, it approaches traders who put money into the bonds.

If rates of interest rise, the cash you’ve now may have considerably much less shopping for energy in the future. This is the primary purpose that the majority traders allocate a lot https://cex.io/ of their money holdings to money-equal cash market accounts or mutual funds. Though these types of highly liquid investments generate solely a modest amount of interest, it may be enough to offset the results of inflation over time.

Since the bond now pays a comparatively low rate in comparison with market charges, the bond’s value will in all probability fall. Some bonds are callable, which means that although the company has agreed to make payments plus interest towards the debt for a certain time period, the company can choose to pay off the bond early.

- Remember that new bonds are repeatedly coming to market, and the prices of present particular person bonds tend to maneuver when prevailing interest rates available in the market change.

- When prevailing rates of interest fall, conversely, a person bond’s worth typically rises, because the rate of interest on the present bond now seems extra engaging than what newer bonds are offering.

- Currently, that difference in yield is comparatively small, however there have been times when the disparity has been wider due to situations within the bond market.

- When charges on new bonds go up, the worth of previously issued individual bonds falls, as a result of the older bonds’ lower rates imply they pay buyers much less curiosity than newer bonds.

- Fixed fee bonds are topic to rate of interest danger, which means that their market prices will decrease in value when the widely prevailing interest rates rise.

- However, none of these fee changes have an effect on the bond’s terms, and it doesn’t matter what occurs to the market price of a bond, you can always maintain on until maturity and obtain the predefined payout.

Are bonds better than cash?

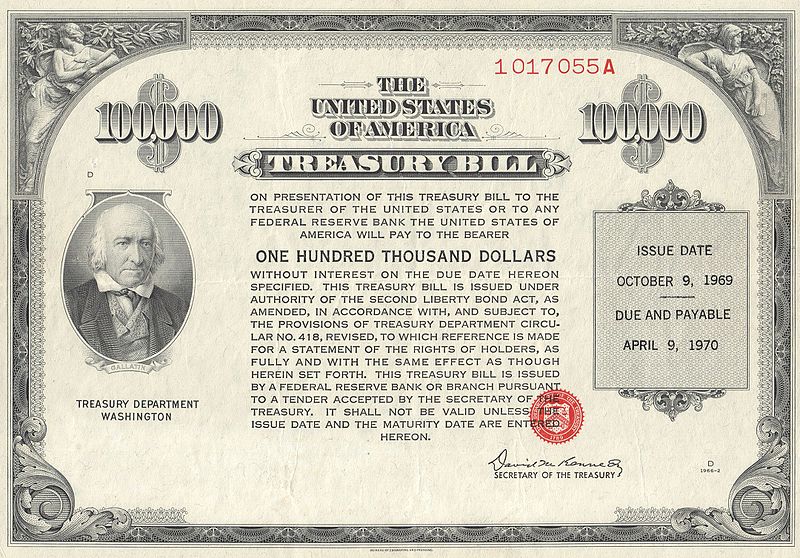

Real World Bond Example A bond represents a promise by a borrower to pay a lender their principal and usually interest on a loan. Bonds are issued by governments, municipalities, and corporations.

Understanding Interest Rates, Inflation And Bonds

Treasury bonds as part of monetary policy that stimulates the economy by decreasing interest rates. I am a CFP skilled with extensive experience working with rich and affluent purchasers. After 30 years, having worked with a number of the largest companies in the world, I will try to raise the veil and take you behind the scenes of the financial Bonds companies industry. My aim is to educate traders on numerous aspects of the economy and monetary markets, and reveal steps you can take to strengthen your private finances and keep away from some frequent pitfalls. I will talk about the universe of investments together with mutual funds, ETFs, bonds, and stocks.

In this case, Coke must promote 10 million bonds at $1,000 each to lift its desired $10 billion before paying the charges it would incur. As traders enter retirement and thereafter, they often move extra of their belongings to bonds, while leaving only slightly in stocks (or none at all). This method offers them with a more steady income stream during a stage of life when they might not be able to afford a considerable decline in their investments. Some retirees could even go for an all-bond portfolio, accepting the trade-offs that make it sub-optimum in a extremely inflationary surroundings. Bond swapping is another approach to obtain a tax-associated objective for buyers who are holding a bond that has declined in worth since purchase but have taxable capital features from other investments.

Is a bond a loan?

Bonds in general are considered less risky than stocks for several reasons: Most bonds pay investors a fixed rate of interest income that is also backed by a promise from the issuer. Stocks sometimes pay dividends, but their issuer has no obligation to make these payments to shareholders.

In exchange for the capital, the corporate pays an interest coupon—the annual rate of interest paid on a bond, expressed as a proportion of the face value. The firm pays the curiosity at predetermined intervals—usually annually or semiannually—and returns the principal on the maturity date, ending the mortgage. This is the danger that investors could have issue finding a buyer when they wish to promote and may be pressured to sell at a big discount to market value. To minimise this threat, investors could wish to opt for bonds which might be part of a big problem dimension and likewise most recently issued.

The iShares fund has a bias towards mortgage-backed securities that the Vanguard fund lacks, especially on the government-issued facet of the market. Vanguard has a slight desire for Treasury and federal authorities agency debt, making up for the smaller allocation to mortgage-backed securities. In addition, the Vanguard fund has a slightly smaller percentage of its assets invested in high-rated bonds, which explains its slightly Bonds larger present yield. Regardless, for those seeking broad-based mostly publicity to the bond market, either of these funds is an efficient start. According to The Wall Street Journal, interest rate adjustments have probably the most affect on bond costs.

While bonds and bond funds can stay secure or produce features throughout a bear market, they don’t seem to be assured profitable investments. Also, when the Fed ends financial stimulus, bond yields may begin to rise as bond prices start to fall. The major reason for this inverse relationship is that bonds, especially U.S. Treasury bonds, are thought-about a safe haven, which makes them extra attractive to investors than volatile shares in such instances. In addition, to reduce unfavorable economic influence, the Federal Reserve is often a purchaser of U.S.

Why do people buy bonds?

Bond Risks Similarly, bonds issued by very highly rated U.S. corporations are typically very low-risk investments. 7 Of course, the interest rates paid on these high-quality bonds are often lower than those paid on junk bonds or other risky investments, but their stability may be worth the trade-off.

The Fidelity Investments website recommends a minimum of $one hundred,000 to $200,000 to put money into particular person bonds. To be taken critically by a dealer who can steer you to good bond selections, you must consider buying municipal or corporate bonds in increments of $25,000, $50,000 or $one hundred,000. It’s essential to notice that nobody can precisely predict how bonds or shares https://www.binance.com/ will carry out within the short time period—or in a recession. For most traders, a balanced portfolio of broadly diversified stock funds and bond funds, suitable in your risk tolerance and funding goal, is sensible. Although bonds are sometimes known as “secure haven” investments, that may be deceptive.

The World’s Highest Government Bond Interest Rates

In truth, bonds are doing so well that buyers are questioning whether or not they should add extra bonds to their investments. Bonds might be a safer funding than shares, however they’re certainly not foolproof. Be mindful of the bond issuer’s credit standing and the bond’s period https://1investing.in/bonds/. If you’re buying bonds from a brokerage, do your research to avoid extreme charges. Though it’s not advisable to construct a complete portfolio of bonds, bonds could be a good passive investment to make whilst you handle riskier investments.